An individual who purchases a modified life insurance policy expects a comprehensive financial safety net that aligns with their evolving needs and aspirations. This specialized insurance product offers a unique blend of protection, investment opportunities, and customizable features, catering to the diverse requirements of policyholders.

Modified life insurance policies provide a range of benefits and coverage options, ensuring financial security for the policyholder and their beneficiaries. These policies also offer potential tax advantages, making them an attractive financial planning tool.

Benefits and Coverage

Modified life insurance policies offer a range of benefits and coverage options to provide financial security for policyholders and their beneficiaries. These benefits include:

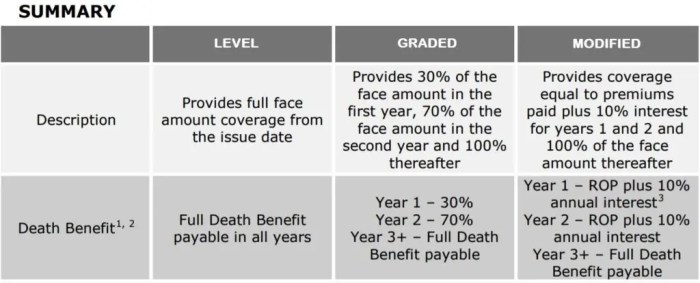

- Death benefit:The primary benefit of a modified life insurance policy is a death benefit, which is paid to the beneficiaries upon the policyholder’s death.

- Cash value:Modified life insurance policies accumulate a cash value component that can be borrowed against or withdrawn tax-free.

- Riders:Riders are optional add-ons that can provide additional coverage, such as coverage for accidental death or dismemberment, or long-term care.

Premiums and Costs

The premiums for modified life insurance policies are influenced by several factors, including:

- Age:Premiums generally increase with age, as the risk of death increases.

- Health:Individuals with pre-existing health conditions may pay higher premiums.

- Lifestyle factors:Smokers and individuals who engage in high-risk activities may pay higher premiums.

Riders and Additional Features

Common riders and additional features that can be added to modified life insurance policies include:

- Accidental death and dismemberment rider:Provides additional coverage in the event of accidental death or dismemberment.

- Long-term care rider:Provides coverage for long-term care expenses.

- Waiver of premium rider:Waives the premium payments if the policyholder becomes disabled.

Investment Options, An individual who purchases a modified life insurance policy expects

Modified life insurance policies offer a range of investment options within the cash value component, including:

- Fixed interest accounts:Offer a guaranteed rate of return.

- Variable interest accounts:Offer the potential for higher returns, but also carry more risk.

- Indexed interest accounts:Offer a combination of fixed and variable returns.

Policy Structure and Flexibility

Modified life insurance policies offer various policy structures and flexibility options, including:

- Level premium:Premiums remain the same throughout the life of the policy.

- Graded premium:Premiums start low and gradually increase over time.

- Flexible premiums:Policyholders can adjust their premium payments within certain limits.

Quick FAQs: An Individual Who Purchases A Modified Life Insurance Policy Expects

What are the key benefits of a modified life insurance policy?

Modified life insurance policies offer a combination of death benefit protection, cash value accumulation, and potential tax advantages.

How do premiums for modified life insurance policies vary?

Premiums are influenced by factors such as age, health, lifestyle, and the type of policy chosen.

What riders and additional features can be added to a modified life insurance policy?

Common riders include accidental death benefits, waiver of premium riders, and long-term care riders.

How do investment options within modified life insurance policies work?

Policyholders can choose from a range of investment options, such as stocks, bonds, and mutual funds, to grow their cash value over time.

Why is it important to review and update modified life insurance policies over time?

Regular reviews ensure that the policy remains aligned with changing needs and circumstances, maximizing its effectiveness.